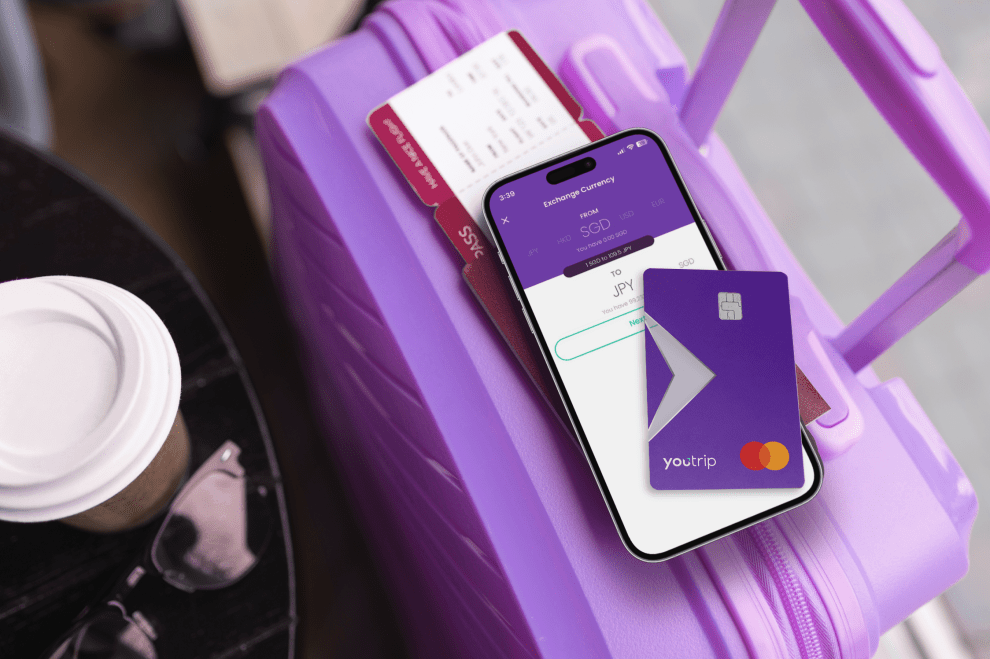

After securing a Series B led by Lightspeed, YouTrip, a fintech company established in Singapore that provides SMEs with corporate cards and multi-currency consumer wallets, is targeting expansion throughout Southeast Asia. With this $50 million round, YouTrip has raised $100 million since its 2018 start.

With the additional capital, YouTrip can expand into new Southeast Asian markets, including Indonesia, Malaysia, the Philippines, and Vietnam, and hire over 100 new employees for its regional team. The Monetary Authority of Singapore has granted the firm a license as a major payment institution. Its services include cards, remittances, foreign exchange, and payments.

YouTrip has handled about USD 10 billion in yearly transaction volume since its founding five years ago. Since its Series A in 2021, the annualized transaction volume of its e-commerce payments has increased by 238%.

TechCrunch last covered YouTrip in November 2021, when it received $30 million in Series A funding from well-known Asian family offices that wished to remain anonymous but were repeat investors. Chu tells TechCrunch that YouTrip benefited from having family offices as a supporter since such connections are often quite long-lasting. This time, YouTrip collaborated with a business with venture capital backing.

When Chu and I last spoke two years ago, YouTrip was getting over the epidemic and traveling again throughout Southeast Asia, particularly Singapore. With more SMBs embracing digital banking services, it was also getting ready for the introduction of its corporate card, YouBiz. They may invoice customers worldwide in various currencies and make and receive payments in numerous currencies thanks to YouBiz.

The firm reports that in the past two years, YouTrip’s user base has tripled and that consumer multi-currency purchasing in Singapore and Thailand has increased significantly. They credit this to the rebound in tourism following the epidemic and the region’s ongoing e-commerce expansion.

Since its inception in May last year, its B2B product, YouBiz, has onboarded over 3,000 firms, hoping to triple that number by 2024. YouBiz’s main target market consists of companies with fewer than 100 workers. Many companies in the technology sector, such as IT companies and startups, are frequently among the first to use new digital goods. However, Chu notes that established industries like travel agencies and healthcare have also shown interest in YouTrip.

Because YouBiz offers SMEs foreign exchange discounts on Google, Facebook, and other subscription tools, often invoiced in USD, the most prevalent use cases for the card are business travel and digital marketing expenses. Businesses also pay suppliers and distant employees via YouBiz’s remittance services. Chu claims that because of YouBiz’s YouBiz rewards program, which collaborates with partners to offer cash-back discounts to clients and aims to promote more frequent and larger transactions, e-commerce is becoming more and more significant for the company.

The ongoing digitalization of SMEs and the pandemic-expedited consumer behaviors are two factors that contribute to YouTrip’s growing advantage.

YouTrip intends to leverage artificial intelligence (AI) and other cutting-edge technology in its product development process to offer personalized features like intelligent budgeting and tailored financial insights. For YouBiz, the business will expand its services to support SMEs’ goals for cross-border expansion, introducing credit lines and additional features for its expenditure management system.

Chu is thrilled about new legislation in Singapore that would increase e-wallet transaction ceilings by three or four times and speed up its foreign market development.

She adds that if the wallet capacity is raised, we will add more FX-related services there, such as international transfers, international money receiving, and more. “We feel that this is a great opportunity for us to build more for our existing customers,” she says.

She claims that YouTrip and YouBiz’s emphasis on localization sets them apart from other multi-currency wallets, SME accounts, and corporate cards. YouTrip now has a bigger market share as a result.

We customize the card design and our mobile apps for each of our markets. Chu adds that it works well for us because it’s so concentrated and localized—from partner selection to other aspects.

“We believe that our localization approach gives us a competitive edge, especially in consumer fintech and digitalization,” she continued. “At the moment, we are particularly enthusiastic about the digitization of SMEs. I believe the epidemic has given us both the chance and the necessity. Businesses must be able to operate remotely, automate processes, and digitize everything. They also want to be able to automate themselves.

However, she points out that, in contrast to neobanks and other fintechs, 99% of SMEs continue to utilize traditional banks.

“I believe there is even more opportunity, and the revolution is just starting,” she states. “We can’t wait to enter there with the infrastructure we have already constructed. One of the very few SMEs in the finance space with our proprietary tech stack and licensing is us.

Lightspeed partner Pinn Lawjindakul told investors, “My personal experience of the pain point reinforced my conviction in what the YouTrip deal has built.” Thanks to their multi-currency digital payments platform, everyone may enjoy a safer, more intelligent, and better experience with foreign currencies and digital payments.